Could you give us a quick introduction to Daiken Medical? What are your company’s main competencies, and what allows your company to stand out among your competition?

Firstly, our company handles all steps in the process at once. We conduct fundamental research, manufacturing, and distribution of our merchandise, including a direct line to Japanese hospitals, covering the entire Japanese market. This means that we don’t require any other companies to assist us. I believe this is the origin of our creation of very innovative devices.

Secondly, we have many creative scientists, each specializing in different fields, such as electronics, mechanical engineering, software, etc. They visit university hospitals, perceive the problems of currently marketed devices, discuss with doctors, keep making prototypes, and eventually come up with innovative ideas. These ideas are protected by patents. We sell only products protected by patents, allowing us to avoid the kind of price competition that often spirals out of control.

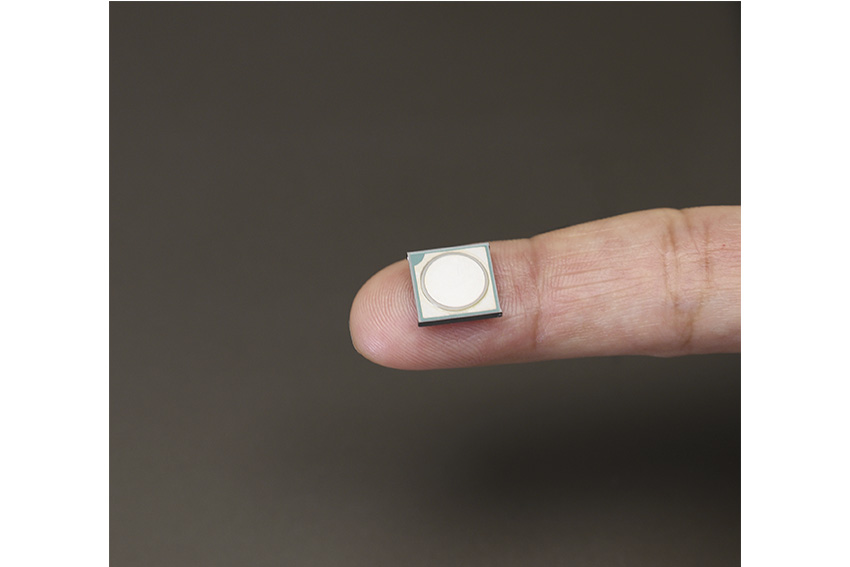

Thirdly, we own fundamental MEMS technology. MEMS stands for Micro-Electro-Mechanical Systems. In the course of developing an accurate and compact drug delivery system, it became unavoidable to create a completely new micro pumping unit that had to be small and inexpensive. After 10 years of research, in collaboration with a German institute, we succeeded in the mass production of the micro pump (MP). We believe this technology can be applied to create many great medical devices. Three years ago, we launched AMY, which is equipped with MP. AMY can inject pain relievers and anticancer drugs over a long period of time or at programmed intervals with great accuracy.

Japan, as everyone knows, has been hit hard in recent years by its population crisis. Nearly 30% of the country’s population is over the age of 65, straining public finances due to rising social security costs and a lower tax base. The healthcare industry is now shifting its priorities from treatment to prevention, leveraging IT, extensive data analysis, and automation for a multitude of applications, from personalized care to reducing both medical and nursing expenses. Hospitals are undertaking community-based, integrated care initiatives to integrate healthcare, welfare, lifestyle support services, and the management of healthcare issues. Could you tell us how this is affecting your business and what opportunities or challenges this situation creates for your company?

Reduction of medical expenses is the key driver of our R&D efforts. We believe that good ways to achieve this include shortening the period of hospitalizations or transferring safe medical treatments from hospitals to homes.

By introducing endoscopic surgery, which involves minimally invasive procedures, we can heal wounds quickly, avoid complications, and shorten hospitalization periods.

By introducing AMY, we can perform anticancer drug treatments (chemotherapy) at home and care for terminal cancer patients at home.

By introducing our new suction system, which keeps the mouth clean to avoid aspiration pneumonia, we can care for bedridden elderly persons.

Making chemotherapy patients more comfortable at home is an important and noble task. The Japanese medical industry thrives on high-quality products, significant innovation, and rigorous standards. The integration of data analysis, automation, and AI is accelerating innovation and economic growth; however, challenges do exist. Earlier, we mentioned the population crisis, but there’s also the 2024 problem, competition from overseas firms, and the rise of non-traditional players leveraging automation expertise to enter the market and potentially dominate it. Do you consider the growing foreign competition and the rise of non-traditional players a threat, or do you perceive it as an opportunity for new partnerships, joint ventures, and technological innovation?

When we entered the suction business 35 years ago, the market was dominated by two big American companies, Baxter and Abbot. We then invented FF, which was equipped with liquid-coagulating technology, and began competing with them. We eventually triumphed. Nowadays, 85% of all operations are carried out using FF.

When we entered the infuser business 20 years ago, Baxter dominated the market. The infuser is a disposable pump that injects pain relievers. We introduced Syrinjector, the first atmospheric pressure-driven pump, ensuring accurate injection. Now, we hold the top market share in Japan. From the beginning, there has been no clear border between the domestic and international markets.

I believe that non-traditional players with new technology that isn’t well known in the medical field often bring a big wave of advancement in medical technology, which is very welcome.

We will either ride these waves or strive to be the company that creates the first wave.

Ultra-small micropump

A continued criticism of the Japanese medtech industry is its regulatory process, which is often considered lengthy and complex, especially compared to the United States and Europe, despite efforts to expedite it. This serves as a hindrance to innovation and further slows down medtech advancements. What are your thoughts on the current regulations in Japan, and how are you navigating them? Can you elaborate on what medical tech reforms are needed from the government to facilitate expansion and growth in the domestic industry?

I spoke with a person in charge of the regulatory process. He said that in the past, the Japanese regulatory process was lengthy, complex, and tedious. However, nowadays, the Japanese process is as streamlined as the EU and FDA processes. The Japanese government has also increased the number of examiners tenfold.

To make a good partnership, we must be strong and expert in at least several steps of the process. We can then fill in the gaps on the road to success.

For example, we have strong technology in drug delivery systems, and we’ve already proven its effectiveness in the domestic market. The next step is to find a partner eager to introduce this technology to the global market.

Japan’s R&D spending was 3.5% of its GDP last year, second only to Korea. Notably, 80% of Japan’s medtech R&D is funded by private enterprises, the highest ratio globally. This is partly due to significant growth in Japan’s USD 40 billion medical industry. Projections estimate a compound annual growth rate of 6.75% from 2023 to 2028, driven by demand for minimally invasive procedures, patient-centric advancements, strong healthcare infrastructure, an aging population, rising diseases like diabetes, and support for both domestic and international partnerships. What investments are you making in R&D, and what is the focus of your future R&D strategy?

We operate in a small niche in medicine. However, we are eager to expand our reach into fields such as internal medicine and surgery—specifically, insulin pumps and devices for endoscopic surgery. We plan to drastically increase investment in R&D to achieve this.

While you hold a dominant market position in Japan, the international landscape is different, with many challenges and competitors. What would you say are your company’s main competitive advantages? How do you differentiate from global competitors?

We’ve achieved small successes in a small field in Japan. We’re confident that we can achieve similar success in other areas of medicine in Japan if we increase our investment. However, it’s true that the international market presents new challenges. To succeed internationally, we need a great partner who can provide us with important information about customer demands.

Amy PCA

Daiken Medical is recognized for cutting-edge medical technologies, and COOPDECH was born from a steadfast commitment to innovative R&D. COOPDECH is lauded for its patient-centered approach, simplicity, and improvement in health accessibility. You mentioned winning the market against big American companies in Japan. Could you elaborate on the strategies you are implementing to meet these rivals?

AMY is a good example. We have an advanced drug delivery system protected by numerous patents. Our sales in Japan have increased significantly.

There are more than 10 global giants in the market. We are currently in talks with the biggest manufacturer of electric pumps in the EU. If they don’t have ambulatory pumps (portable pumps), they are eager to acquire and distribute them. We can help fill that gap.

Only one global giant dominates the USD 2 billion global market for insulin pumps. Other giants are looking for competition. If we can create the world’s smallest and most affordable insulin pump and introduce it to them, something great may happen. Please note that we plan to sell the pump domestically ourselves.

The pharmaceutical industry is heavily regulated by national and state authorities. Every country has its own good manufacturing practices (GMP) regulations to ensure the safety and quality of medical devices. Your company operates factories in Taiwan, Thailand, and Vietnam, exporting to countries like Brazil, Germany, and other parts of Asia. You’ve mentioned beating big US firms in Japan as a first goal. Once that is achieved, would you consider seeking international co-creation partners? If so, what kind of partner would you be looking for, and which countries would you focus on?

The reason we chose a large manufacturer in the EU is that, in the future, we plan to ask them to manufacture AMY for the European market, excluding the core MP. The company already has factories in North America. If AMY is approved in the US, we will ask their factories there to produce it.

Despite stiff competition, medtech partnerships are a mainstay in the international industry. Medtech companies often work with foreign competitors to leverage their ability to create better technologies. Could you run us through the process of establishing the partnership you just mentioned?

I can’t name the company, but it’s a giant in the industry. They are responsible for distributing many types of pumps, but there are some gaps in their product portfolio that we can fill. We approached their director of research and arranged a meeting at a prominent medical exhibition in Germany. At expos, information is exchanged, allowing us to gain an in with this global leader. The last step is regulatory approval, which, as you know, takes time.

Control postoperative pain using a smartphone app – Amy’s Window

We all know that the “made-in-Japan” brand is known for its quality and reliability, especially in the medical field. However, Daiken Medical also has manufacturing bases in Taiwan, Thailand, and Vietnam. How do you maintain the same quality as Japan in these overseas locations?

Even though we ask companies in Thailand to manufacture our devices, we design and build the key components in Japan. They are shipped to our partners for final assembly. Most importantly, we send our specialists to our factories to ensure quality control. The made-in-Japan label means we are responsible for ensuring the highest standard of quality, regardless of where a product is assembled.

Could you speak more about your international strategy? You mentioned AMY and the potential to partner with a European manufacturer. What are your broader plans for international expansion, and what markets are you prioritizing?

We’re focusing on Europe and North America as our key target markets. These regions not only have significant healthcare infrastructure but also offer strong regulatory frameworks that, while stringent, provide opportunities for high-quality, innovative products to succeed.

We’ve already started building a network of distributors and partners across Europe. In the U.S., we are exploring FDA approvals, which are critical for any medical device entering the American market. Additionally, we’ve identified opportunities in emerging markets like Southeast Asia and Brazil, where there is increasing demand for advanced medical technologies but with a focus on affordability.

Given the advancements in artificial intelligence and machine learning, how do you foresee these technologies playing a role in the medtech industry and particularly within Daiken Medical’s future product offerings?

AI and machine learning are transforming medtech by enabling more personalized and predictive healthcare. In the future, we plan to integrate AI into our drug delivery systems to provide real-time monitoring and feedback on patient health.

For example, a future version of AMY could use AI to analyze patient data and adjust drug dosages automatically, improving the effectiveness of treatments and reducing the risk of human error. Additionally, AI could enhance post-market surveillance by identifying trends in device usage and outcomes, which would help us refine and improve our products continuously.

As a final question, what does the future hold for Daiken Medical in the next five to ten years? What are your main goals and ambitions for the company moving forward?

Our main goal is to expand internationally while continuing to develop cutting-edge technologies. Over the next five to ten years, we plan to become a global leader in drug delivery systems and other niche medical devices. We will continue to invest heavily in R&D, especially in areas like AI and MEMS technology.

We also aim to expand our product portfolio beyond our current offerings, entering new areas of medicine such as internal medicine, surgery, and possibly even robotics. The ultimate ambition is to make high-quality medical care more accessible and affordable, not just in Japan but globally.

In doing so, we hope to continue improving patient outcomes while also helping to reduce healthcare costs through innovative, efficient solutions. The future is bright, and we’re excited to play a leading role in shaping the future of healthcare.

For more information, visit:

link

More Stories

Avant Technologies and JV Partner, Ainnova, Accelerate Expansion Across Latin America Following Key Role at Healthcare Innovation Summit

The Human Side of Tech-Enabled Healthcare – Sponsor Content

Leading medical providers, innovations lauded at Healthcare Asia Awards 2025